Why do people like making planned gifts?

Planned gifts (most commonly a donation made in your will or trust) cost nothing today and allow you to make an incredible impact, which is why so many people choose to make them.

There are some other exciting but less common gifts — scroll down to learn more!

Please let us know if you’ve already included us in your estate plans!

Letting us know is incredibly helpful to our team and helps to make sure your gift is used the way you want it to be.

Impact our Future through Gift Planning

Planned giving is an opportunity to create a lasting legacy and help OU achieve its goals for current and future generations. We mean it when we say that without supporters like you, none of our work is possible. Your commitment today helps ensure OU’s academic offerings remain innovative and within reach for the talented, driven students of tomorrow.

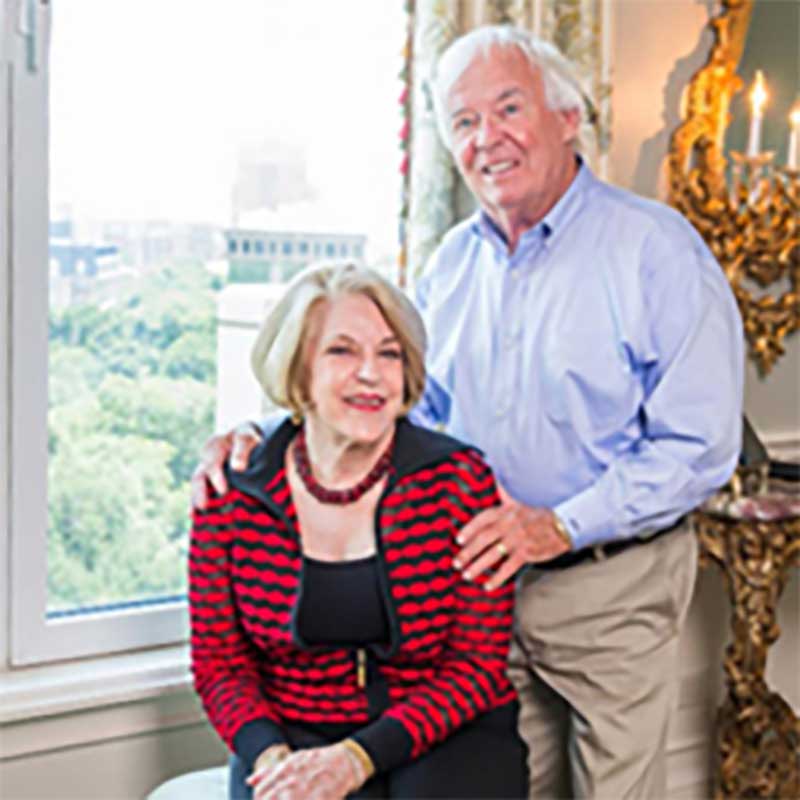

Dave and Judi Proctor’s Story

Albert Camus once said, “Real generosity toward the future lies in giving all to the present.” Through their generosity, Dave and Judi Proctor are ensuring the success of future generations of students at the University of Oklahoma.

Read more

Neva Cochran’s Story

If there’s one thing OU alumna Neva Cochran wants the world to know, it’s that proper nutrition is about eating beyond the headlines.

Read more

Kelsey Condley’s Story

Kelsey Condley isn’t the average estate gift donor at the University of Oklahoma. Kelsey and his wife Melissa, both in their early 40s, are younger than most people who decide to leave the university in their wills. Planned gifts and estate gifts to OU ensure that a certain pre-determined amount of a donor’s estate will, on that person’s passing, go to the university via the OU Foundation.

Read moreFrequently Asked Questions

Yes! Gifts of any size are deeply appreciated. Many people choose to leave a percentage of their estate, which scales up or down with your estate size.

Yes! Knowing in advance about your intentions is quite helpful to our staff, but you are always welcome to not share your gift.

Yes. You are always free to revise or update your estate plans.

Meet Our Team

We’re here to help you meet your goals!

Our team would be happy to speak with you in confidence about your giving goals, with no obligation.

Name: Jay Kahn

Title :Senior Assistant Vice President for Advancement and Campaigns

Phone: 405-310-4865

Already included us in your estate plan? Let Us Know