Donna touched so many lives through her dedicated career in education, and she isn’t finished yet. She plans to give to both OU’s softball team and College of Education.

“Access is what I want my gift to pursue,” Donna said. “There are so many bright and talented young people who just don’t have doors opened for them. If that barrier can be removed, then I want to be part of that.”

She hopes her gifts lay the groundwork for students and athletes alike to pursue their dreams at OU and thrive after graduation.

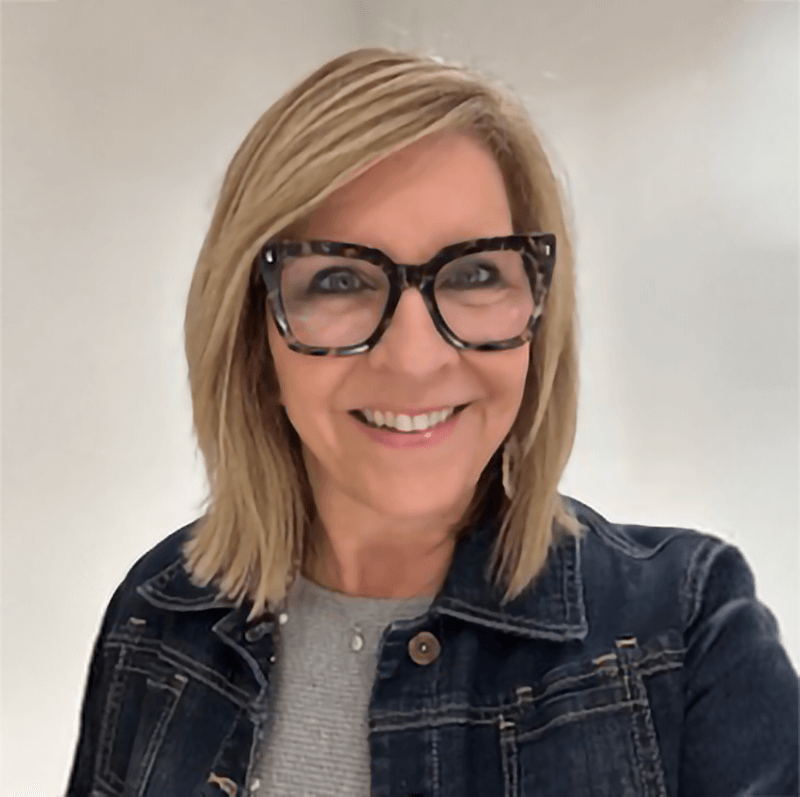

Donna Neel’s journey from first-generation college student to lifelong educator and advocate is intertwined with her deep affinity for the University of Oklahoma. Now, she is combining her love of softball, education, and OU with her philanthropic efforts to ensure Sooners of tomorrow have access to the same opportunities and experiences she holds so dear.

Donna grew up in Muskogee, where her parents raised her with a strong sense of purpose and determination. Believing in the power of generational advancement, they hoped to see their children excel beyond the circumstances in which they were raised.

“My parents always encouraged me to think about college, but with one restriction — it must be in state,” Donna said. “I knew very early on that I wanted to come to OU.”

Donna began her freshman year at OU in the fall of 1974 and enrolled in the College of Education.

“I pursued special education,” Donna said. “A lot of people think that if you pursue this field, you must have had an experience with someone in your life that may have needed special education services, but I didn’t. I kind of have this innate need to be a defender of the underserved, a champion for those that need more help,” Donna said.

She was a champion of more than just underserved communities, though. In addition to her studies, Donna was a collegiate athlete. In 1976 and 1977 – when Title IX was in its infancy and women’s athletic scholarships were scarce – Donna competed on the OU softball team.

“You have a few significant moments in time that really change your whole path,” Donna said. “And you don’t realize it until you’re on the other side.”

While seeking out her own community at OU, Donna came across a bulletin board with a tear-off flyer advertising softball tryouts. She took a tab, attended tryouts at “pneumonia downs” (a former workout and track facility under the spectator stands at Memorial Stadium), and made the team.

“That changed the trajectory of my life,” Donna said.

Donna competed for two years under coaches Amy Dahl and Marita Hynes, legendary early leaders of OU’s softball program. Current head softball coach Patty Gasso credits pioneers like Dahl, Hynes, and Donna for building the foundation for today’s wildly successful program. At the 50th anniversary of OU softball, Coach Gasso told the attendees, “We’re standing on your shoulders.”

“That meant a lot,” Donna said.

Donna has established a precedent of excellence for more than just OU softball. After graduation, she began a 46-year career in public education in Blanchard and Norman, serving in the classroom and as a principal. She then transitioned to Lexia Learning, a company that provides training for teachers and resources for students who struggle to read.

Donna touched so many lives through her dedicated career in education, and she isn’t finished yet. She plans to give to both OU’s softball team and College of Education.

“Access is what I want my gift to pursue,” Donna said. “There are so many bright and talented young people who just don’t have doors opened for them. If that barrier can be removed, then I want to be part of that.”

She hopes her gifts lay the groundwork for students and athletes alike to pursue their dreams at OU and thrive after graduation.

“I’m going to start an endowment with the College of Education, probably targeted for first-generation college students,” Donna said. “And I want women to have the opportunity to participate at the highest level of athletics… everything you do in athletics is transferable to real life.”

Donna’s thoughtful philanthropy is rooted in decades of disciplined financial planning, much of it inspired by her parents.

“My parents just modeled this so well… they planned so well for their future through disciplined saving, and they were really transparent about it in our home,” she said.

She began saving early in her career, opening an annuity as a 22-year-old teacher in Blanchard.

“It’s almost embarrassing. You feel inferior when you talk about giving when you’re young, because you feel like the little you have isn’t enough… But I said, ‘Okay, I’ll contribute $25 a month [to savings]’” Donna recalled. “And what that taught me is discipline, financial discipline.”

That early habit of giving and the long-term perspective it cultivated eventually led her to support OU in larger ways. From making annual gifts through the Sooner Club to preparing a legacy gift through her estate, Donna has never lost sight of what OU gave her: opportunity, purpose, and lifelong community.

From the classroom to the softball field, from early saving habits to estate planning, Donna Neel’s story is one of purpose, perseverance, and generosity. Her legacy will ensure that students for generations to come can find the same sense of belonging, opportunity, and pride that she found at OU.